2010 is almost “in the books” and the general theme for the year is stable prices but scarce buyers. Overall activity is slightly up from 2009, but prices are up about 5% on average. Here are the numbers from the entire Carolina MLS:

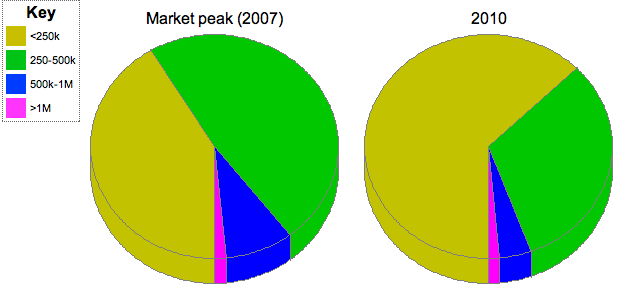

(Note: all charts in this report refer to the market “peak” in 2007 and include both single-family homes and condos)

The higher price ranges bounced back a bit from 2009 even though number of overall sales was stagnant. So if you were working with a buyer who could buy (as opposed to the glut of “tire kickers” out there these days), chances are they spent a bit more than in 2009.

The “Haves” & the “Have Nots”

Not every area saw similar numbers. Some areas actually saw fewer sales and/or lower prices from 2009. The trend seems to be worst for the pricier areas that are not in the most desired school districts. For example, Area 6-1 (parts of Dilworth, Sedgefield):

The $250-$500k segment was absolutely hammered compared to the peak in 2007, and that also happens to be the average price point of the area. So, even though the $500k-$1M segment saw some growth, the average price actually went down about 2% (and activity also went down).

Compare this to Area 5-1 (Myers Park, Dilworth) that is in the more desirable school districts:

In this area, activity was up over 40% and prices by 20%! The $500k-$1M range isn’t close to what it was in 2007 but the over $1M range bounced back nicely from 2009.

Just for fun (or not), here’s Uptown:

Activity was up slightly (though still down a whopping 70% from the market peak), but prices were actually down about 6%. The main culprit here seems to be both the $250-500k and the $500k-$1M ranges, which were strong at the peak, but now down signficantly.

What lies ahead?

It’s tough to say what’s in store for 2011. Based on the trends, it would seem safe to assume that just as 2010 was a little better than 2009, 2011 will be a little better than 2010. The question is how many willing & able buyers have (thus far) chosen not to buy. With 2009 looking more & more like the true “bottom” in terms of price, it seems reasonable to assume that some of those “scared” buyers will hit the ground in 2011.

In general, it appears that homes in “established” areas with desirable school districts stand to do the best, while previously “hot” areas that experienced a fast rise in value (i.e. Midwood, parts of Dilworth) are a tougher sell because those buyers haven’t come back in full force yet and inventory is high.

If there are any specific areas for which you’d like these stats, we have them easily available! Just drop us a line!